A Complete Manual for Conducting International Flight Operations

International Fueling

International Fueling

Misfuelings are so common at international locations that they should be anticipated regardless of how developed or explicit the crew is with their fueling instructions. Misfuelings may be caused by: language barriers; the fueler’s lack of familiarity with the aircraft being operated; fuelers not being aware of whether the fuel truck is supposed to terminate fueling when a gallon amount is reached; or whether the aircraft and crew will “auto stop fueling.” Discrepancies will also occur due to misunderstanding the use of gallons, liters, etc.

For these reasons it is recommended that while at international locations that fueling is always supervised by a flight crewmember.

Requesting Fuel

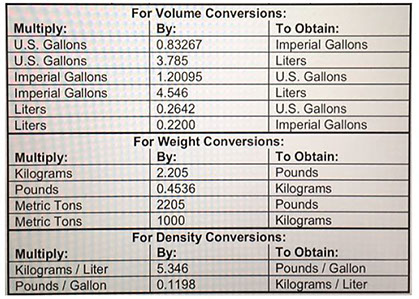

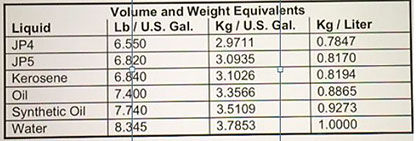

When requesting fuel, the desired fuel quantity requested should be written on a sheet of paper and presented to the fueler with the appropriate unit of measure, gallons, liters, etc. If a conversion is required, the fuel conversion shall be conducted by the flight crew, and the fuel quantity should be requested in the unit of measure familiar to the fueler.

Upon completion of fueling the fuel quantity shall be verified between crewmembers to determine that sufficient quantity exists for the intended flight.

Tax Considerations

Recomendations for VAT and Excise Tax

As flight crewmembers, we should do the following when operating in a foreign country to ensure that VAT and Excise Taxes are billed correctly.

- Speak to your handler and service provider so you know what to expect for VAT and Excise Taxes

- Ensure that the fueler has a copy of the fuel release- Do not attempt to give the fueler a credit card because it may invalidate VAT exemptions which have been arranged by the handler

- Carry printed copies of the Air Carrier Certificate which may be required to be furnished to the fueler or customs department

- Do not sign a fuel ticket until you have determined that the correct VAT or Excise taxes have been assessed. It is difficult to go back later and the taxes removed.

- Contact a reputable International Fuel provider such as Universal Aviation for any questions.

VAT and Excise Tax

Excise taxes are simply taxes imposed by the government on goods or services. These taxes can have a significant impact on your operations unless you are knowledgeable and have planned accordingly. As flight crewmembers the one tax that affects us the most are taxes imposed on fuel purchases. An important difference between Excise taxes and VAT taxes are that Excise taxes are flat fees, whereas VAT taxes are based on a percentage. Neither tax is mutually exclusive. In fact, you may be charged an Excise tax which adds $3 per gallon and then you may be charged a VAT tax which is a percentage based on the price per gallon plus the Excise tax. In short, the taxes may more than double the per gallon price of fuel, which makes fuel tankering decisions even more critical.

Depending on the country that you are in the excise taxes may bear different names. For instance, in France excise taxes are called TIPP, or Taxe Interieure sur les Produits Petroliers-National Tax on Petroleum Products, In Germany they are called MOT, or mineral oil tax, etc.

If you operate under FAA Part 135 it is possible to avoid excise taxes in certain countries with restrictions. In France you may be able to avoid excise taxes if you have an Air Carrier Certificate and 80% of the flights are conducted for higher and the operator conducts trips which are international in nature. In Austria an operator may be exempt from excise if they have an Air Carrier Certificate and operate commercially more than 50% of the time. Some countries like Switzerland have further restrictions which require the aircraft to be fueled within 3 hours of departure and require that the flight be connected with a commercial flight operation. The government entity may request verification of commercial operations as proof and it is not uncommon at the time of fueling to have the fueler request the Air Carrier Certificate of the operator. As of this writing Belgium, the United Kingdom and Ireland do not impose excise on fuel.

Fuel Tankering

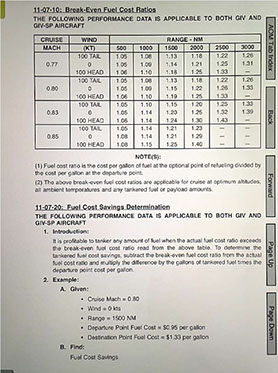

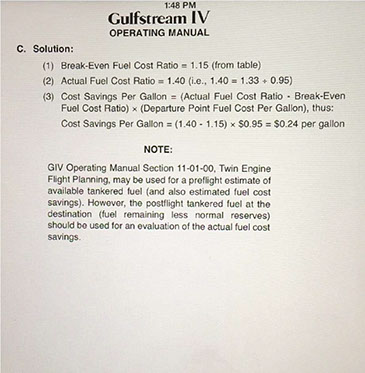

Long range aircraft have the ability to carry large amounts of fuel which exceed the trip fuel required. Crewmembers shall be proficient in determining whether it may be cost efficient to “tanker” fuel from a departure airport where fuel is cheaper. Pilots have several means to evaluate fuel tankering scenarios. For Gulfstream pilots fuel tankering charts may be found in the AOM- Aircraft Operating Manual Chapter 11.

Long range aircraft have the ability to carry large amounts of fuel which exceed the trip fuel required. Crewmembers shall be proficient in determining whether it may be cost efficient to “tanker” fuel from a departure airport where fuel is cheaper. Pilots have several means to evaluate fuel tankering scenarios. For Gulfstream pilots fuel tankering charts may be found in the AOM- Aircraft Operating Manual Chapter 11.

Other Resources

Fuel Density

For a great discussion on fuel densities in Asia, click here

Apps

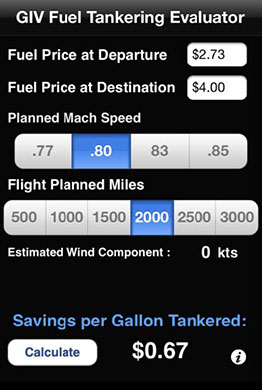

Electronic versions are also available on the App Store which are aircraft specific. The below example is specific to the G-IV.

JOIN THE CONVERSATION

The material contained on this site is to be used for reference only. You should always follow your primary resources first (aircraft manuals, government regulations, etc.).

Savant Aero is no way affiliated with any aircraft manufacturers.